Auto & Transport Roundup: Market Talk

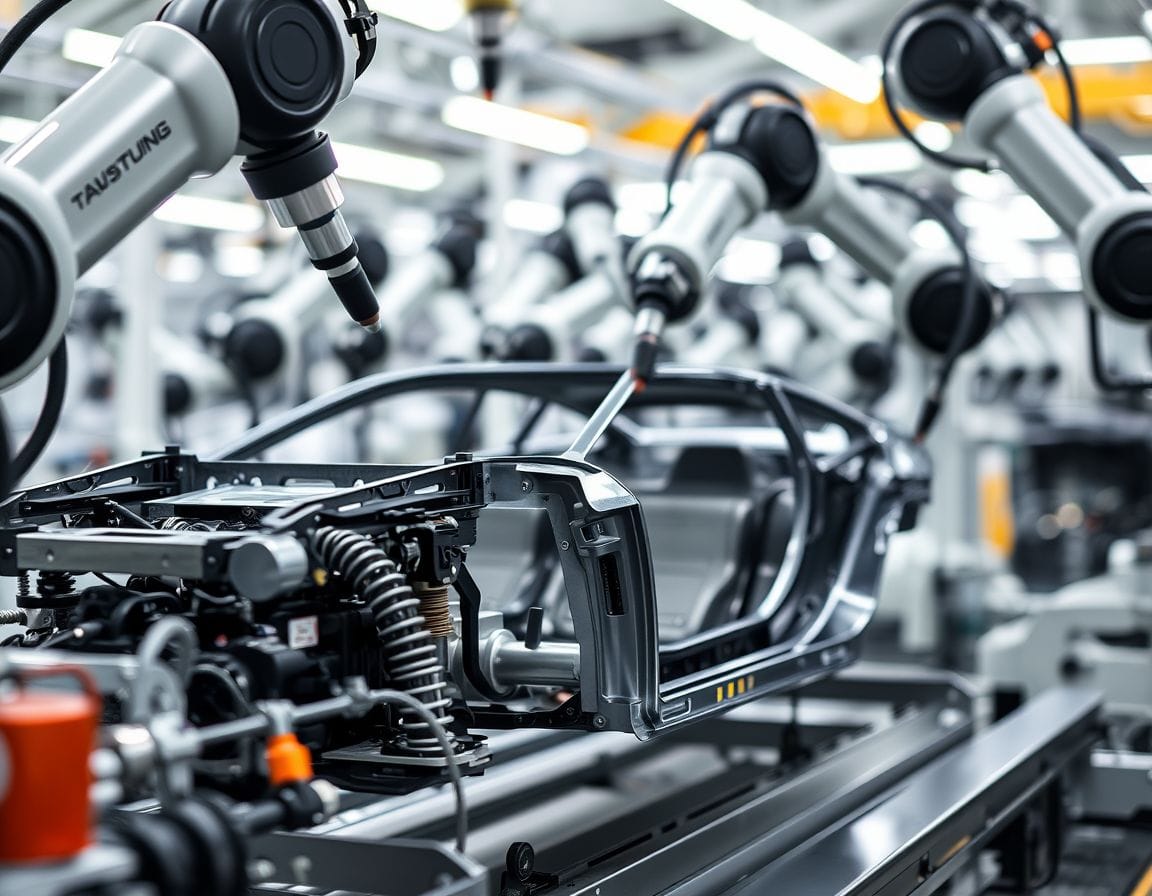

The automotive and transport sectors continue to navigate a complex landscape, with manufacturers and suppliers alike facing persistent supply chain challenges, shifting consumer preferences, and the ever-present pressure of electrification. In this week's Market Talks, we delve into key developments impacting major players like Renault and Cummins, offering insights into their strategies and the market forces shaping their trajectories.

Renault's Electrification Push Faces Speed Bumps

Renault, the French automotive giant, is aggressively pursuing its electrification strategy, aiming to become a leader in the electric vehicle (EV) market. The company has unveiled ambitious plans for new EV models and battery production facilities. However, recent market data suggests that Renault's EV sales growth, while significant, is not quite keeping pace with some of its competitors.

Several factors are contributing to this. First, the ongoing chip shortage continues to hamper production across the industry, and Renault is not immune. This limits the availability of its EV models, preventing it from fully capitalizing on the growing demand. Second, the price of raw materials, particularly lithium and nickel used in batteries, remains elevated, putting pressure on Renault's profitability. While the company is actively seeking to secure long-term supply contracts, the volatility in the commodities market presents a constant challenge.

Furthermore, Renault is facing increasing competition from established automakers like Volkswagen and Tesla, as well as a wave of new EV startups. To differentiate itself, Renault is focusing on innovative battery technology and strategic partnerships. For example, its collaboration with a Chinese company for battery manufacturing aims to reduce costs and improve efficiency. The success of Renault's electrification push will depend on its ability to overcome these hurdles and effectively execute its long-term strategy.

Cummins Navigates the Transition to Alternative Fuels

Cummins, a leading manufacturer of engines and power generation systems, is grappling with the transition to alternative fuels. While the company is investing heavily in electric and hydrogen technologies, it recognizes that diesel engines will remain a significant part of the market for years to come, especially in heavy-duty applications.

Cummins is pursuing a dual-track approach. On one hand, it is developing electric powertrains for buses, trucks, and construction equipment. On the other hand, it is investing in improving the efficiency and reducing the emissions of its diesel engines. This includes exploring the use of alternative fuels like biodiesel and renewable diesel, which can significantly lower the carbon footprint of existing diesel vehicles.

The challenge for Cummins lies in balancing its investments in new technologies with the need to maintain its core business. The company is facing pressure from regulators and investors to accelerate its transition to zero-emission technologies, but it also needs to ensure that it can continue to meet the demands of its customers who rely on diesel engines. Cummins' long-term success will depend on its ability to navigate this transition effectively and provide its customers with a range of sustainable power solutions.

Beyond the Headlines: Other Market Movers

Besides Renault and Cummins, several other factors are influencing the auto and transport sectors:

- Supply Chain Disruptions: The global supply chain remains fragile, with ongoing disruptions affecting the availability of semiconductors, raw materials, and components. This is forcing automakers to reduce production, raise prices, and delay new product launches.

- Inflationary Pressures: Rising inflation is impacting consumer spending and demand for new vehicles. Higher interest rates are also making it more expensive for consumers to finance car purchases.

- Regulatory Changes: Governments around the world are implementing stricter emission standards and providing incentives for electric vehicle adoption. This is accelerating the transition to electric mobility and creating new opportunities for companies that can provide innovative solutions.

The auto and transport sectors are undergoing a period of profound transformation. Companies that can adapt to these changes and embrace new technologies will be best positioned to succeed in the long run. Navigating the complexities of electrification, alternative fuels, and evolving regulations will be critical for survival in this dynamic market.