Ford’s First-Quarter Profit Drops 64%; Suspends Outlook

Ford Motor Co. reported a steep 64% drop in its first-quarter profit, shaking investors and prompting the automaker to pull its profit forecast for the entire year. The significant decline, announced Wednesday, stems from a combination of factors, including higher warranty costs and ongoing uncertainties surrounding international trade, particularly tariffs.

The company’s net income fell to $1.3 billion, a considerable slide from the $3.6 billion reported during the same period last year. While revenue increased slightly to $42.8 billion, the gains were overshadowed by the profit slump, raising concerns about Ford's financial health and future performance.

One of the primary drivers behind the profit decrease was an unexpected surge in warranty costs. The company attributed this to issues with certain vehicles, leading to increased recall and repair expenses. While Ford didn't specify the exact models causing the problem, the cost burden significantly impacted the bottom line.

Beyond internal challenges, the unpredictable nature of international trade policies, specifically tariffs, played a pivotal role in Ford's decision to suspend its full-year outlook. The company cited the potential for further tariffs on steel, aluminum, and other imported components as a major source of uncertainty.

"The global trade environment remains fluid," a Ford representative stated in a press release. "The potential impact of tariffs on our costs and competitiveness makes it difficult to accurately forecast our full-year performance."

This suspension of the company's financial outlook adds another layer of anxiety for investors already wary of the auto industry’s vulnerability to economic downturns and shifting consumer preferences. Shares of Ford initially dipped in after-hours trading following the announcement.

The decision to withdraw the outlook signals a lack of confidence in the company’s ability to navigate the current market conditions and accurately predict future earnings. This move could further erode investor confidence and put pressure on Ford to deliver a convincing turnaround strategy.

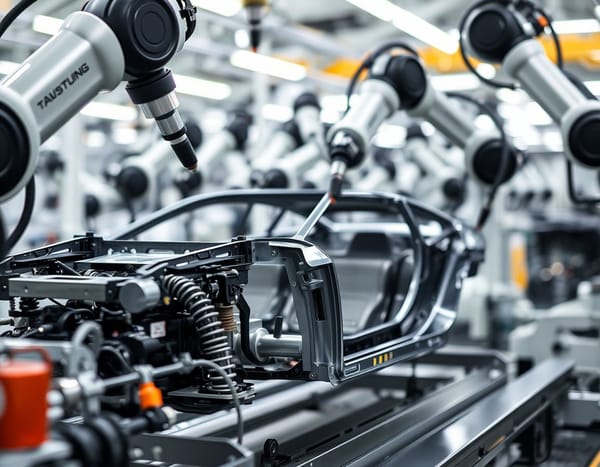

While Ford is facing headwinds, the company is pushing forward with its restructuring plan, aimed at streamlining operations, cutting costs, and investing in electric vehicles and autonomous driving technology. However, the benefits of this multi-year plan are not expected to materialize immediately, leaving the company vulnerable to short-term market fluctuations.

Ford isn’t alone in facing challenges from tariffs. Other automakers with global supply chains have voiced concerns about the potential impact of trade disputes on their profitability. However, Ford’s decision to suspend its outlook highlights the severity of the issue and the level of uncertainty it creates.

The company emphasized its commitment to closely monitoring the global trade environment and adjusting its strategies as needed. But for now, investors are left waiting for greater clarity on the company’s future prospects.

The immediate future remains uncertain, with Ford needing to address both internal operational issues and the external challenges posed by trade disputes. The company will need to demonstrate a clear path to recovery to regain investor confidence and ensure long-term sustainable growth.

Ford is not only dealing with trade winds. As an old car manufacturer, it has to contend with the threat of electric cars as new, hip brands join the market to compete. The company has publicly committed to electric vehicles, but investors are unsure if its offerings will be able to stand up to competitors.

While the immediate focus is on navigating the current challenges, Ford's long-term success hinges on its ability to adapt to the changing automotive landscape, invest in innovative technologies, and address the operational inefficiencies that have contributed to its recent struggles.