Rippling's Latest Stock Sale: What You Need to Know

Introduction

Rippling, a leading HR startup, recently conducted a significant stock sale valued at over $2 billion. This article breaks down the key details of the sale and its impact on current and former employees.

The Stock Sale

- In April, Rippling announced a tender offer of up to $590 million for employees and existing investors, alongside a $200 million Series F for the company.

- The deal valued Rippling at $13.5 billion, making it the largest and most profitable sale for the company to date.

Eligibility and Restrictions

- The offer was open to both current and former employees, allowing them to sell up to 25% of their vested equity.

- Former employees who work for specific competitors, such as Workday and Gusto, were excluded from participating in the sale.

- Employees who previously sold shares outside of company tender offers were subject to additional restrictions on selling their stock.

Exclusion of Ex-Employees at Competitors

- Rippling excluded employees at competitor companies to prevent sensitive information from being shared with rivals.

- The company defended its decision, stating that it was necessary to protect confidential financial information from falling into the hands of competitors.

Rippling vs. Deel

- Rippling's rivalry with Deel, a competing company, played a role in the exclusion of ex-employees working at competitors.

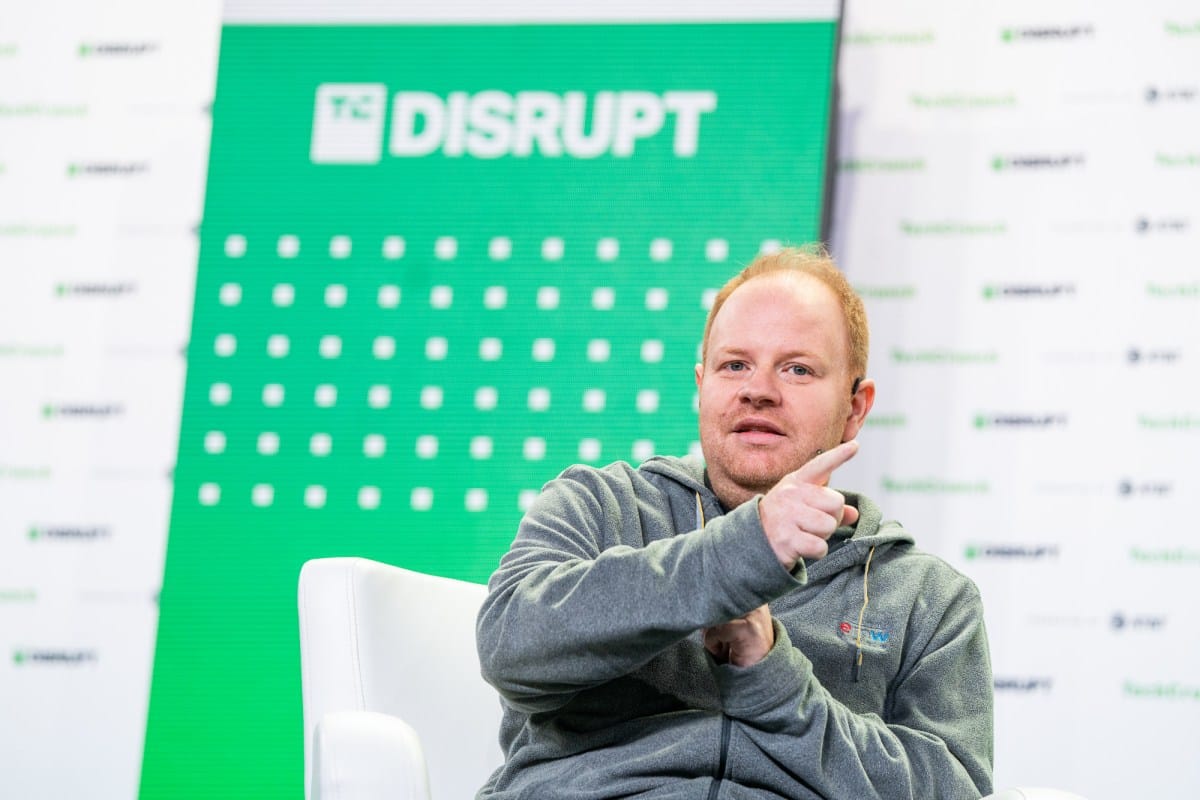

- Founder and CEO Parker Conrad's competitive nature and history with previous startups influenced the decision to exclude certain employees.

Future Stock Options

- All employees, current or former, will have the opportunity to sell their stock after a lockup period once the company goes public.

- Despite the financial aspect, some employees impacted by the exclusion felt hurt by the company's decision to exclude them from the lucrative deal.

Conclusion

Rippling's recent stock sale has generated significant interest and controversy, particularly regarding the exclusion of ex-employees at competitor companies. The company's decision reflects its commitment to protecting sensitive information and maintaining a competitive edge in the HR tech market.